Surety Bond Manager

Liberty Mutual - Englewood, CO

Surety Bond Manager

Oops! This job has expired, but don’t worry.

Explore other exciting job listings and take the next step in your career journey!

109

Asset Manager

jobs413

jobs in

Englewood, CO

21

jobs at

Liberty Mutual

Job

Company

Description

Salary

Skills

Benefits

Job Description

*Launch your Underwriting career at Liberty Mutual Insurance - A Fortune 100 Company! *

Liberty Mutual Surety™ has an excellent opportunity for a Bond Manager with on our Surety Plus team in Englewood, CO.In this role, you will be responsible for managing all aspects of a field office servicing the surety needs of customers within an assigned territory for our small contract and subdivision book and generating consistent PTOI earnings. This includes preparing the budget and business plans, marketing, underwriting, training, and monitoring a business portfolio, and coordinating management and administrative functions within the regional territory. You are also accountable for meetingnew business target, premium & expense budgets and PTOI target goals as assigned.

Liberty Mutual Surety, a business unit of Liberty Mutual Insurance, is the 2nd largest Surety in the United States and a leading global surety. Conducting business worldwide through fronting relationships and Liberty-owned subsidiaries, we provide bonds in over 60 countries for construction firms, manufacturers and suppliers, and commercial enterprises on an account and transactional basis. We are committed to building mutually profitable relationships by providing smart business solutions, ease of doing business, and consistent, responsive service. Liberty Mutual Surety is dedicated to the communities we serve and highly values a diverse workforce in more than 16 countries.

Responsibilities:

-

Manage assigned staff and expenses to meet business and career objectives as well as the small-contractproduct line development, generating consistent PTOI and growthwith profit being the primary objective. Prepare the budget and business plans, expense management, reporting, etc. as appropriate, andcoordinates and monitors the implementation of the annual business plans of each of the offices or multi-state territory within area of responsibility. May participate in annual & strategic business planning process.

-

Ensure that new and existing accounts/principals continue to meet underwriting guidelines and standards for credit worthiness. Manages the portfolio book of business.

-

Manage field contract surety underwriter activities with regards to establishing and executing marketing/ production efforts for assigned territories andassist underwriters with respect to technical underwriting issues, meetings with agents, contractors and others, as necessary.

-

Initiates and monitors visits to producers and clients to promote marketing programs/activities and obtain necessary underwriting data. Develop new business and retain existing accounts. Cultivate business relationships through industry related organizations to enhance the image of the Company and to promote marketing effectiveness.

-

Continually monitors quality of performance of staff by utilization of a variety of tools, including but not limited to personal observation, surveys, underwriting information, financial files & communicating with customers. Identifies problems & implements corrective action.

-

Ultimately responsible for ensuring that new underwriters are trained and/or supported by experienced underwriters with respect to technical underwriting issues, meetings with agents, accounts, etc., and that those enrolled in the Surety Underwriting Development Program complete all aspects of the curriculum. Ensures underwriting staff receives assigned training as appropriate.

-

Manage and oversee evaluations and recommendations of credit levels provided to all customers and assist underwriters to properly evaluate and select credit risks while actively participating in major underwriting decisions on all risks. Ensures that risks pursued and that new and existing accounts/principals continue to meet underwriting guidelines and standards for credit worthiness. Manages the portfolio book of business with responsibility for servicing the surety needs of customers. Oversees, as a resource, acquisitions of new business and portfolio management.

-

Manages all marketing and acquisition efforts of staff within the field office territory to secure new business targets/goals. Manages portfolio, profitability, risk mitigation, growth strategies, metrics for specific accounts and overall book of business, and the servicing of the most complex risks associated with the field office.

-

Monitors utilization, compliance, and accuracy of Surety system applications for underwriting, marketing and accounting needs of assigned territory.

-

Hiring, training and other performanceofficemanagement functions including mid-year and annual review, regular 1:1, and coaching activities. Develops individual performance objectives and development plans and insures alignment with business objectives. Appraises and evaluates team and individual performance and makes compensation recommendations.

-

Special projects as assigned.

Qualifications:

-

Bachelors Degree typically required. Advanced Degree preferred, and continuing Surety education desired

-

Success driven individual with a minimum of 10 years progressive surety underwriting experience expected, including a minimum of 2 years of proven underwriting management experience, preferred.

-

Proven track record of growth and profitability in small contractor and subdivision Surety segments.

-

Proven analytical ability to evaluate and judge underwriting risks within scope of responsibility.

-

Demonstrated ability to communicate complex analyses and information in understandable written and/or oral directives to other persons in the organization for underwriting or training purposes.

-

Thorough knowledge of surety underwriting guidelines with a strong preference of contract surety expertise handling small-mid sized accounts.

-

Must possess following skills, abilities and attributes: strong leadership skills, development of people, strategic thinking, sustained effective portfolio management and profitable growth, communication skills, decision-making skills, results-oriented, industrious, innovative, problem-solving skills, coaching and mentoring skills, and negotiating skills.

-

Demonstrated effective communication and interpersonal skills and the ability to interact successfully with agents, brokers, CPAs, bankers, attorneys, etc. to build and maintain good business relationships required.

-

The salary range indicated represents a broad range of experience, in which the highest level would be based on surety-specific background.

*

*

Benefits:

We value your hard work, integrity and commitment to positive change. In return for your service, it’s our privilege to offer you benefits and rewards that support your life and well-being. To learn more about our benefit offerin gs please visit:https://LMI.co/Benefits

Overview:

At Liberty Mutual, we give motivated, accomplished professionals the opportunity to help us redefine what insurance means; to work for a global leader with a deep sense of humanity and a focus on improving and protecting everyday lives. We create an inspired, collaborative environment, where people can take ownership of their work; push breakthrough ideas; and feel confident that their contributions will be valued and their growth championed.

We’re dedicated to doing the right thing for our employees, because we know that their fulfillment and success leads us to great places. Life. Happiness. Innovation. Impact. Advancement. Whatever their pursuit, talented people find their path at Liberty Mutual.

Job: *Underwriting

Title: Surety Bond Manager

Location: CO-Englewood

Requisition ID: 114411

This job was posted on Sat Dec 05 2020 and expired on Sat Dec 26 2020.

Find out how you match this company

Liberty Mutual

Summary

Liberty Mutual Insurance helps people preserve and protect what they earn, build, own, and cherish. Keeping this promise means we are there when our customers need us most. Throughout our operations around the world, we are committed to providing insurance products and services to meet the needs of individuals, families, and businesses offering a diverse and dynamic work environment for our employees and supporting our communities.

How do you prioritize and manage multiple assets simultaneously?

Answer

I prioritize assets based on their importance and urgency, and use project management tools to track progress and ensure timely completion.

How do you assess the financial performance of assets?

How do you handle conflicts or disputes related to asset management?

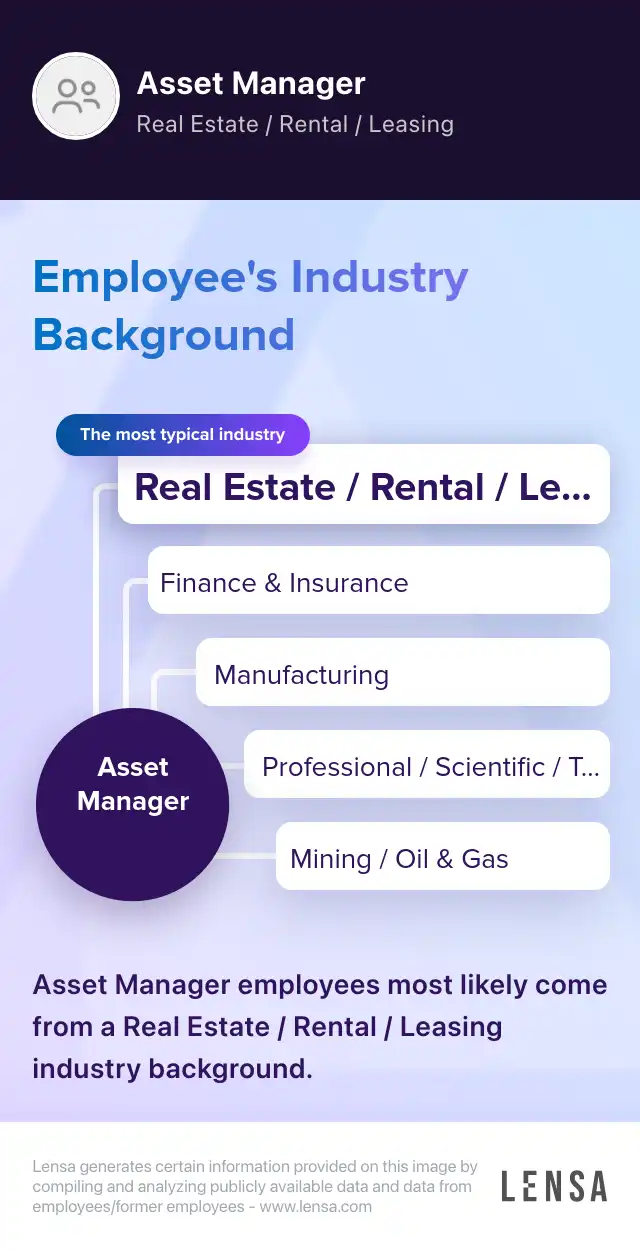

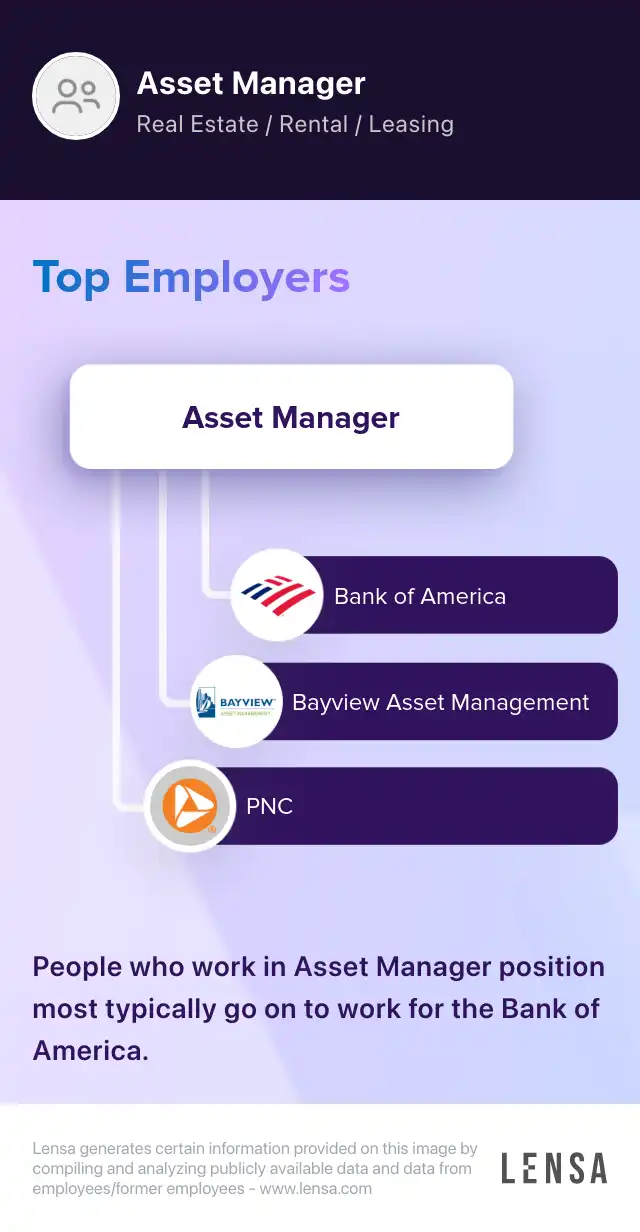

About the Asset Manager role

Management - Other Asset Manager

As Asset Managers, we manage worthy assets such as bonds, capital, commodities, stocks, real estate properties and precious metals. We manage assets for individuals and corporate clients to help them have an insight into the stock and commodity markets.

Core tasks:

- quantitative and analytical skills to make economically valid decisions

- create reports for client's knowledge

- assist in the preparation of financial portfolios and models

- managerial and organizational skills to assist present and potential clients

109 Asset Manager jobs in Englewood, CO

Similar jobs in the area